capital gains tax increase date

The bottom line though is simply to understand that with 7 ordinary income tax brackets plus 4 long-term capital gains brackets with the 38 Medicare surtax tax planning and evaluating marginal tax rates is a function of not just the ordinary income or long-term capital gains rates themselves but also the interrelationship of the two and the indirect but substantial. Long-term capital gains tax is a tax applied to assets held for more than a year.

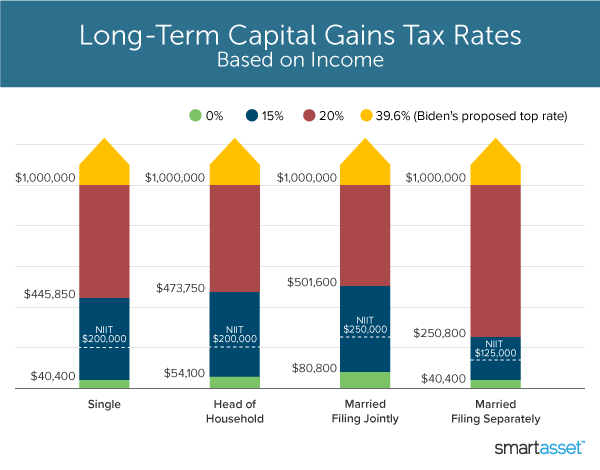

The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. No capital gains tax is incurred on inventory assets. This new bill even refers to applying the proposed 14 tax rate to compensation From. The inclusion rate is the same for everyone but the amount of tax you pay depends on your.

Proving yet again that taxes rates continue to creep up once in place even before the court has had a chance to rule on the capital gains income tax or the first tax payments are owed a new bill has been filed to increase the tax rate from 7 to 14 for some types of income. Say you bought 100 shares of XYZ Corp. Capital gains tax might result from selling your home stocks bonds commodities mutual funds a business and other similar capital assets.

No capital gains tax applies if the property was bought before September 20 1985. How the Capital Gains Tax Works. I note you have stated the property is more than 100 years old but this has no.

The long-term capital gains tax rates are 0 percent 15 percent and 20 percent depending on your income. Stock at 20 per share and sold them more than a year later for 50 per share. Capital gains tax has a universal inclusion rate of 50 meaning you are only taxed on half your profit.

You get beneficial tax treatment if you hold an asset for more than a year. In this case you pay long-term capital gains tax rates. You pay short-term capital gains tax rates if you keep the asset for a year or less.

These rates are the same as the usual ordinary income tax rates you pay on your income which could be as high as 35 depending on various state laws. Individuals paid capital gains tax at their highest marginal rate of income tax 0 10 20 or 40 in the tax year 20078 but from 6 April 1998 were able to claim a taper relief which reduced the amount of a gain that is subject to capital gains tax thus reducing the effective rate of tax depending on whether the asset is a business asset or a non-business asset and the length. Capital gains tax is owed when you sell a non-inventory asset at a higher price than you paid resulting in a realized profit.

Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Definition 2021 Tax Rates And Examples

How To Calculate Capital Gains Tax H R Block

Pin By Dua Financial Fmp Bonds Els On Dua Capital Tax Free Investments Taxact Investing

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

What S In Biden S Capital Gains Tax Plan Smartasset

Taxation In Australia Wikipedia Capital Gains Tax Income Tax Return Payroll Taxes

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)